UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ý

Filed by a party other than the Registrant¨

Check the appropriate box:

¨ Preliminary Proxy Statement

¨ Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

ý Definitive Proxy Statement

¨ Definitive Additional Materials

¨ Soliciting Material under §240.14a‑12

NLIGHT, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | | | | | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ý | No fee required |

| | |

| ¨ | Fee paid previously with preliminary materials |

| | |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | |

4637 NW 18th Avenue

Camas, Washington 98607

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:00 a.m. Pacific Time on Thursday, June 9, 20226, 2024

Dear Stockholders of nLIGHT, Inc.:

We cordially invite you to attend the 20222024 annual meeting of stockholders (the “Annual Meeting”) of nLIGHT, Inc., a Delaware corporation, which will be held on Thursday, June 9, 2022,6, 2024, at 9:00 a.m. Pacific Time. This year’s Annual Meeting will be a completely virtual meeting of stockholders. You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/LASR2022LASR2024 where you will be able to listen to the meeting live, submit questions and vote online. We are holding the Annual Meeting for the following purposes, as more fully described in the accompanying proxy statement:

1.To elect the Class IIII director nominees named in the accompanying proxy statement to serve until the 20252027 annual meeting of stockholders and until their respective successors are duly elected and qualified;

2.To ratify the appointment of KPMG LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022;2024;

3.To approve, on an advisory, non-binding basis, the compensation of our named executive officers; and

4.To transact such other business that may properly come before the Annual Meeting or any adjournments or postponements thereof.

Our board of directors has fixed the close of business on April 11, 2022,8, 2024, as the record date for the Annual Meeting. Only stockholders of record on April 11, 2022,8, 2024, are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on Thursday, June 9, 2022. 6, 2024. On or about April 28, 2022,26, 2024, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement and annual report. The Notice provides instructions on how to vote via the Internet, telephone or mail (if you receive printed proxy materials) and includes instructions on how to receive a paper copy of our proxy materials. The accompanying proxy statement and our annual report can be accessed directly at the following Internet address: www.proxyvote.com. All you have to do is enter the control number located on your Notice or proxy card.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting, we urge you to submit your vote via the Internet, telephone or mail as soon as possible. We appreciate your continued support of nLIGHT.

By order of the Board of Directors,

Scott Keeney

President and Chief Executive Officer

Camas, Washington

April 28, 202226, 2024

TABLE OF CONTENTS

nLIGHT, INC.

PROXY STATEMENT

FOR 20222024 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 9:00 a.m. Pacific Time on Thursday, June 9, 20226, 2024

We are furnishing this proxy statement and the enclosed form of proxy in connection with a solicitation of proxies by our board of directors for use at the 20222024 annual meeting of stockholders of nLIGHT, Inc., a Delaware corporation (the "Company"), and any postponements, adjournments or continuations thereof (the “Annual Meeting”). The Annual Meeting will be held virtually on Thursday, June 9, 2022,6, 2024, at 9:00 a.m., Pacific Time. You can attend the Annual Meeting by visiting www.virtualshareholdermeeting.com/LASR2022,LASR2024, where you will be able to listen to the meeting live, submit questions and vote online. The Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access this proxy statement and our annual report is first being mailed on or about April 28, 2022,26, 2024, to all stockholders entitled to vote at the Annual Meeting.

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully. Information contained on, or that can be accessed through, our website is not intended to be incorporated by reference into this proxy statement and references to our website address in this proxy statement are inactive textual references only.

| | | | | | | | | | | | | | |

THE PROXY PROCESS AND STOCKHOLDER VOTING:

QUESTIONS AND ANSWERS |

What matters am I voting on?

You will be voting on:

•the election of the twothree Class IIII director nominees who are named in the accompanying proxy statement to serve until our 20252027 annual meeting of stockholders and until their respective successors are duly elected and qualified;

•a proposal to ratify the appointment of KPMG LLP ("KPMG") as our independent registered public accounting firm for our fiscal year ending December 31, 2022;2024;

•a proposal to approve, on an advisory, non-binding basis, the compensation of our named executive officers; and

•any other business as may properly come before the Annual Meeting.

How does the Board of Directors recommend I vote on these proposals?

Our board of directors recommends a vote:

•“FOR” the election of Scott KeeneyDouglas Carlisle, Bill Gossman and Camille NicholsGary Locke as Class IIII directors;

•“FOR” the ratification of the appointment of KPMG as our independent registered public accounting firm for our fiscal year ending December 31, 2022;2024; and

•“FOR” the approval, on an advisory, non-binding basis, of the compensation of our named executive officers.

Who is entitled to vote?

Holders of our common stock as of the close of business on April 11, 2022,8, 2024, the record date for the Annual Meeting, may vote at the Annual Meeting. As of the record date, there were 44,539,01147,562,870 shares of our common stock outstanding. Our common stock will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors. Each share of common stock outstanding as of the record date is entitled to one vote.

Registered Stockholders. If your shares are registered directly in your name with our transfer agent, you are considered the stockholder of record with respect to those shares and we provided the Notice to you directly. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or vote virtually at the Annual Meeting. Throughout this proxy statement, we refer to these registered stockholders as “stockholders of record.”

Street Name Stockholders. If your shares are held on your behalf in a brokerage account or by a bank or other nominee, you are considered to be the beneficial owner of shares that are held in “street name,” and the Notice was forwarded to you by your broker or nominee, who is considered the stockholder of record with respect to those shares. As the beneficial owner, you have the right to direct your broker, bank or other nominee as to how to vote your shares. Beneficial owners are also invited to attend the Annual Meeting. However, since a beneficial owner is not the stockholder of record, you may not vote your shares of our common stock virtually at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal

proxy. If you request a printed copy of our proxy materials by mail, your broker, bank or other nominee will provide a voting instruction form for you to use. Throughout this proxy statement, we refer to stockholders who hold their shares through a broker, bank or other nominee as “street name stockholders.”

Is there a list of registered stockholders entitled to vote at the Annual Meeting?

A list of registered stockholders entitled to vote at the Annual Meeting will be made available for examination by any stockholder for any purpose germane to the meeting for a period of at least ten days prior to the meeting between the hours of 9:00 a.m. and 5:00 p.m., Pacific Time, at our principal executive offices located at 4637 NW 18th Avenue, Camas, Washington 98607 by contacting our corporate secretary. The list of registered stockholders entitled to vote at the Annual Meeting will also be available online during the Annual Meeting at www.virtualshareholdermeeting.com/LASR2022, for those stockholders attending the Annual Meeting.

How many votes are needed for approval of each proposal?

• Proposal No. 1: The election of directors requires a plurality of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon. “Plurality” means that the nominees who receive the largest number of votes cast “for”“FOR” are elected as directors. As a result, any shares not voted “for”“FOR” a particular nominee (whether as a result of stockholder abstention or a broker non-vote (as defined below)) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. You may vote “for”“FOR” or “withhold”“WITHHOLD” on each of the nominees for election as a director.

• Proposal No. 2: The ratification of the appointment of KPMG requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered votes present and entitled to vote on this proposal, and thus will have the same effect as a vote “against”“AGAINST” the proposal. Broker non-votes will have no effect on the outcome of this proposal.

• Proposal No. 3: The advisory non-binding vote to approve the fiscal 20212023 compensation of our named executive officers requires the affirmative vote of a majority of the voting power of the shares of our common stock present virtually or represented by proxy at the Annual Meeting and entitled to vote thereon. Abstentions are considered votes present and entitled to vote on this proposal, and thus will have the same effect as a vote "against""AGAINST" the proposal. Broker non-votes will not affecthave no effect on the outcome of voting on this proposal. Because this vote is advisory only, it will not be binding on us, our board of directors or our compensation committee. Instead, our board of directors and our compensation committee will consider the outcome of the vote when determining the compensation of our named executive officers.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our amended and restated bylaws (the “bylaws”) and Delaware law. The virtual presence or representation by proxy of a majority of all issued and outstanding shares of common stock entitled to vote at the Annual Meeting will constitute a quorum at the meeting. A proxy submitted by a stockholder may indicate that all or a portion of the shares represented by the proxy are not being voted (“stockholder withholding”) with respect to a particular matter. Similarly, a broker may not be permitted to vote stock (“broker non-vote”) held in street name on a particular matter in the absence of instructions from the beneficial owner of the stock. See “How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?” The shares subject to a proxy that are not being voted on a particular matter

because of either stockholder withholding or broker non-vote will count for purposes of determining the presence of a quorum. Abstentions are also counted in the determination of a quorum.

How do I vote?

If you are a stockholder of record, there are four ways to vote:

• by Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on June 8, 20225, 2024 (have your Notice or proxy card in hand when you visit the website);

• by toll-free telephone at 1-800-690-6903 (have your Notice or proxy card in hand when you call), until 11:59 p.m. Eastern Time, on June 8, 2022;

5, 2024;

• by completing and mailing your proxy card (if you received printed proxy materials) to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; or

• by attending the Annual Meeting by visiting www.virtualshareholdermeeting.com/LASR2022,LASR2024, where stockholders may vote and submit questions during the meeting (have your Notice or proxy card in hand when you visit the website). Beneficial owners must obtain a legal proxy from their broker, bank or other nominee to vote during the meeting. Follow the instructions from your broker, bank or other nominee included with the Notice, or contact your broker, bank or other nominee, to request a legal proxy. All votes must be received by the inspector of elections before the polls close during the meeting.

Even if you plan to attend the Annual Meeting, we recommend that you also vote by proxy so that your vote will be counted if you later decide not to attend the Annual Meeting.

If you are a street name stockholder, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee on how to vote your shares. Street name stockholders should generally be able to vote by returning an instruction card, or by telephone or on the Internet. However, the availability of telephone and Internet voting will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a street name stockholder, you may not vote your shares virtually at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

Can I change my vote?

Yes. If you are a stockholder of record, you can change your vote or revoke your proxy any time before the Annual Meeting by:

• entering a new vote by Internet or by telephone;

• completing and mailing a later-dated proxy card;

• notifying the corporate secretary of nLIGHT, Inc., in writing, at nLIGHT, Inc., Attn: Corporate Secretary, 4637 NW 18th Avenue, Camas, Washington 98607; or

• attending and voting at the Annual Meeting (although attendance at the Annual Meeting will not, by itself, revoke a proxy).A stockholder’s last vote is the vote that will be counted.

If you are a street name stockholder, your broker, bank or other nominee can provide you with instructions on how to change your vote.

What do I need to do to attend the virtual Annual Meeting?

You will be able to attend the Annual Meeting online, submit your questions during the meeting and vote your shares electronically at the meeting by visiting www.virtualshareholdermeeting.com/LASR2022. LASR2024. To participate in the Annual Meeting, you will need the control number included on your Notice or proxy card. The Annual Meeting webcast will begin promptly at 9:00 a.m. Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m. Pacific Time, and you should allow ample time for the check-in procedures.

How can I get help if I have trouble checking in or listening to the Annual Meeting online?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Scott Keeney and Joseph Corso with full power of substitution and re-substitution have been designated as proxy holders by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors as described above. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy holders can vote the shares on the new Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

Who will count the votes?

Julie Dimmick, our general counsel and corporate secretary, will tabulate the votes and act as inspector of election.

How can I contact nLIGHT's transfer agent?

You may contact our transfer agent, Computershare Inc., by telephone at (800) 736-3001, or by writing Computershare via regular mail at P.O. Box 505000 Louisville, KY 40233.43078, Providence, RI 02940-3078, or via overnight/certified/registered delivery at 150 Royall Street, Suite 202, Canton, MA 02021. You also may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at www.computershare.com/investor.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our annual report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about April 28, 2022,26, 2024, to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact and cost of our annual meetings of stockholders.

How do we solicit proxies for the Annual Meeting?

Our board of directors is soliciting proxies for use at the Annual Meeting. We will bear all expenses associated with this solicitation. We will reimburse brokers or other nominees for reasonable expenses that they incur in sending our proxy materials to you if a broker, bank or other nominee holds your shares. In addition, our

directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Our directors and employees will not be paid any additional compensation for soliciting proxies.

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

If you hold your shares in street name, you will need to follow the instructions your broker provides to instruct your broker on how to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. The ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 20222024 (Proposal No. 2) is considered to be routine under applicable rules. Since a broker or other nominee may generally vote on routine matters, no broker non-votes are expected to exist in connection with this proposal. The election of Class IIII directors (Proposal No. 1) and the advisory non-binding vote to approve the

compensation of our named executive officers (Proposal No. 3) are considered “non-routine” under applicable federal securities rules. Absent direction from you, your broker will not have discretion to vote on these non-routine matters, and therefore there may be broker non-votes in connection with these proposals.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four business days after the Annual Meeting, we will file a Current Report on Form 8-K to publish preliminary results and will provide the final results in an amendment to the Current Report on Form 8-K after they become available.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure called “householding,” which the SEC has approved. Under this procedure, we deliver a single copy of the Notice and, if applicable, our proxy materials, to multiple stockholders who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces our printing costs, mailing costs, and fees. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice and, if applicable, our proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these materials. To receive a separate copy, or, if a stockholder is receiving multiple copies, to request that we only send a single copy of the Notice and, if applicable, our proxy materials, such stockholder may contact us at the following:

nLIGHT, Inc.

Attention: Corporate Secretary

4637 NW 18th Avenue

Camas, Washington 98607

Tel: (360) 566-4460

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

What is the deadline to propose actions for consideration at next year’s annual meeting of stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next annual meeting of stockholders by submitting their proposals in writing to our corporate secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 20232025 annual meeting of stockholders, our corporate secretary must receive the written proposal at our principal executive offices not later than December 28, 2022.27, 2024. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

nLIGHT, Inc.

Attention: Corporate Secretary

4637 NW 18th Avenue

Camas, Washington 98607

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an annual meeting of stockholders but do not intend for the proposal to be included in our proxy statement. Our bylaws provide that the only business that may be conducted at an annual meeting of stockholders is business that is (1) specified in our proxy materialsnotice of annual meeting (or any supplement thereto) with respect to such meeting, (2) otherwise properly brought before such meeting by or at the direction of our board of directors, or any committee thereof that has been formally delegated authority to propose such business pursuant to a resolution adopted by the affirmative vote of a majority of the total number of authorized directors whether or not there exist any vacancies or other unfilled seats, or (3) properly brought before such meeting by a stockholder who is a stockholder of record (i) at the time of the giving of the advance notice, (ii) on the record date for the determination of stockholders entitled to notice of the annual meeting, (iii) on the record date for the determination of stockholders entitled to vote at the annual meeting, (iv) at the time of the annual meeting and (v) who has delivered timely complied in proper written form with the notice to our corporate secretary, which notice must contain the informationprocedures specified in our bylaws. To be timely for our 20232025 annual meeting of stockholders, our corporate secretary must receive the written notice at our principal executive offices:

• not earlier than 8:00 a.m., Pacific time on February 11, 2023;10, 2025; and

• not later than 5:00 p.m., Pacific time on March 13, 2023.12, 2025.

In the event that we hold our 20232025 annual meeting of stockholders more than 3025 days before or more than 60 days afterfrom the one-year anniversary of the Annual Meeting, notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business8:00 a.m., Pacific time, on the 120th day before our 20232025 annual meeting of stockholders and no later than the close of business5:00 p.m., Pacific time, on the later of the following two dates:

• the 90th day prior to our 20232025 annual meeting of stockholders; or

and

• the 10th day following the day on which public announcement of the date of our 20232025 annual meeting of stockholders is first made.

If a stockholder who has notified us of his, her or its intention to present a proposal at an annual meeting does not appear to present his, her or its proposal at such annual meeting, we are not required to present the proposal for a vote at the annual meeting.

Recommendation and Nomination of Director Candidates

You may propose director candidates for consideration by our nominating and corporate governance committee. Any such recommendations should include the nominee’s name and qualifications for membership on our board of directors and should be directed to our corporate secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board of Directors.”

In addition, our bylaws permit stockholders to nominate directors for election at an annual meeting of stockholders. To nominate a director, the stockholder must provide the information required by our bylaws. In addition, the stockholder must give timely notice to our corporate secretary in accordance with our bylaws, which, in general, require that the notice be received by our corporate secretary within the time periods described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement. Stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must also comply with the additional requirements of Rule 14a-19(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Availability of Bylaws

You may obtain a copy of our bylaws by accessing our filings on the SEC’s website at www.sec.gov. You may also contact our corporate secretary at our principal executive offices for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

| | | | | | | | | | | | | | |

| BOARD OF DIRECTORS AND CORPORATE GOVERNANCE |

Our business affairs are managed under the direction of our board of directors, which is currently composed of eight members. SevenSix of our directors are independent within the meaning of the listing standards of the Nasdaq Stock Market.

Our board of directors is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring. As we mature as a public company, our board of directors intends to remove the classified board structure from our amended and restated certificate of incorporation ("certificate of incorporation"), subject to stockholder approval at a subsequent stockholders’ meeting. For further information about our governance practices, see “Stakeholder Engagement and Governance Practices” below.

The following table sets forth the names and certain other information for each nominee for election as a director and for each of the continuing members of the board of directors as of April 28, 2022.26, 2024.

| | Directors | Directors | Class | Age | Position | Director

Since | Current

Term

Expires | Expiration

of Term

For Which

Nominated | Directors | Class | Age | Position | Director

Since | Current

Term

Expires | Expiration

of Term

For Which

Nominated |

| Director Nominee | |

| Scott Keeney | I | 57 | President, Chief Executive Officer and Chairman | 2000 | 2022 | 2025 |

Camille Nichols(4) | I | 65 | Director | 2020 | 2022 | 2025 |

| Continuing Directors | |

Bandel Carano(4) | II | 60 | Director | 2001 | 2023 | — |

Raymond Link(1)(2) | II | 68 | Director | 2010 | 2023 | — |

Geoffrey Moore(1)(2) | II | 75 | Director | 2012 | 2023 | — |

| Director Nominees | |

Douglas Carlisle(1)(3) | |

Douglas Carlisle(1)(3) | |

Douglas Carlisle(1)(3) | Douglas Carlisle(1)(3) | III | 65 | Director | 2001 | 2024 | — | III | 67 | Director | 2001 | 2024 | 2027 |

Bill Gossman(2)(4) | Bill Gossman(2)(4) | III | 60 | Director | 2016 | 2024 | — | Bill Gossman(2)(4) | III | 62 | Director | 2016 | 2024 | 2027 |

Gary Locke(3) | Gary Locke(3) | III | 72 | Director | 2017 | 2024 | — | Gary Locke(3) | III | 74 | Director | 2017 | 2024 | 2027 |

| Continuing Directors | |

| Scott Keeney | |

| Scott Keeney | |

| Scott Keeney | | I | 59 | President, Chief Executive Officer and Chairman | 2000 | 2025 | — |

Camille Nichols(4) | | Camille Nichols(4) | I | 67 | Director | 2020 | 2025 | — |

Bandel Carano(4) | | Bandel Carano(4) | II | 62 | Director | 2001 | 2026 | — |

Raymond Link(1)(2) | | Raymond Link(1)(2) | II | 70 | Director | 2010 | 2026 | — |

Geoffrey Moore(1)(2)(3) | | Geoffrey Moore(1)(2)(3) | II | 77 | Director | 2012 | 2026 | — |

(1) Member of our audit committee

(2) Member of our compensation committee

(3) Member of our nominating and corporate governance committee

(4) Member of our information and technology security committee

| | | | | |

| Nominees for Director | Director

Since |

Scott Keeney, one of our co-founders, has served as our president, chief executive officer and as a member of our board of directors since July 2000 and as chairman of our board of directors since February 2018. Prior to joining us, from 1998 to 2000, Mr. Keeney served as chief executive officer for Aculight Corporation, a laser company acquired by Lockheed Martin Corporation in 2008. Prior to that, he served as a consultant for McKinsey & Company, a consulting firm, from 1993 to 1998. Mr. Keeney received a B.A. in economics from the University of Washington and an M.B.A. from Harvard Business School.

We believe Mr. Keeney’s perspective, experience and institutional knowledge as our co-founder, president and chief executive officer qualify him to serve on our board.

| 2000 |

Camille Nichols has served as a member of our board of directors since November 2020 and as a member of our information and technology security committee since January 2021. She retired as a Major General in the U.S. Army following an extensive career that included key roles in Department of Defense acquisition and operations. During her career with the Army, Major General Nichols managed significant organizations, operating budgets, and programs. Immediately prior to her retirement from the Army, she served as director of the Sexual Assault Prevention and Response Office within the Office of the Secretary of Defense and as the Deputy Commanding General of the Army’s Installation Management Command. Since July 2020, she has served as the Executive Vice President, Project Services at Amentum, a global technical and engineering services firm, where she is responsible for contracts and procurement, ethics, information systems, security, and real estate. Prior to joining Amentum, Major General Nichols was Vice President of Business Operations of Fluor Corporation’s government group from May 2017 to July 2020. She currently serves on the board of directors of Concurrent Technologies Corporation, a nonprofit, applied scientific research and development professional services organization. She holds a B.S. degree from the United States Military Academy at West Point, an M.S.S.M. degree in systems management from the University of Southern California, and a Ph.D. in engineering management from The George Washington University.

We believe Major General Nichols' extensive background and experience in the U.S. military and defense industry, combined with her technical education and background in operations, procurement and security, qualifies her to serve on our board.

| 2020 |

| | | | | |

Continuing Directors | Director

Since |

Bandel Caranohas served as a member of our board of directors since April 2001, as a member of our compensation committee from February 2004 to December 2012, as a member of our technology security compliance committee from February 2018 to September 2019 and from February 2005 to November 2006, and as a member of our information and technology security committee since January 2021. Mr. Carano is a general partner of Oak Investment Partners, a multi-stage venture capital firm he joined in 1985. From 1983 to 1985, Mr. Carano was a member of Morgan Stanley's Venture Capital Group, where he was responsible for advising Morgan Stanley on high-tech new business development and sponsoring venture investments. Mr. Carano currently serves on the boards of directors of NeoPhotonics Corporation and numerous private companies. Mr. Carano served on the board of directors of Kratos Defense & Security Solutions, Inc. from 1998 to September 2019. Mr. Carano also serves on the Investment Advisory Board of the Stanford Engineering Venture Fund. Mr. Carano received a B.S. and an M.S. in electrical engineering from Stanford University.

We believe Mr. Carano’s technical engineering background and experience advising growth-oriented technology companies as a venture capital investor, coupled with his experience as a director of numerous public and private companies, qualifies him to serve on our board.

| 2001 |

| | | | | |

Raymond Linkhas served as a member of our board of directors since December 2010, as a member of our compensation committee since December 2011 and as a member of our audit committee since December 2010. Since January 2018, Mr. Link has served as a finance lecturer at the University of California, Santa Barbara in a part-time role. From July 2005 to April 2015, Mr. Link served as chief financial officer of FEI Company, a leading supplier of scientific and analytical instruments for nanoscale imaging. Prior to FEI, from July 2001 to June 2005, Mr. Link was the chief financial officer of TriQuint Semiconductor, Inc., a manufacturer of electronic signal processing components for wireless communications which he joined in 2001 as a result of TriQuint's merger with Sawtek, Inc., where he was the chief financial officer. Mr. Link served on the board of directors of Electro Scientific Industries, Inc., a supplier of laser-based solutions for the microelectronics industry, from August 2015 until the completion of its acquisition by MKS Instruments in February 2019, Cascade Microtech from January 2005 until its acquisition by FormFactor in June 2016, and currently serves on the board of directors of FormFactor, Inc., a leading provider of test and measurement solutions for the semiconductor industry. Mr. Link received a B.S. in business administration from the State University of New York at Buffalo and an M.B.A. from the Wharton School at the University of Pennsylvania, is a licensed Certified Public Accountant and a fellow with the National Association of Corporate Directors.

We believe Mr. Link’s financial and accounting expertise, including his service as a chief financial officer and extensive experience as a public company director, qualifies him to serve on our board.

| 2010 |

Geoffrey Moore has served as a member of our board of directors since September 2012, as a member of our audit committee since April 2019, and as a member of our compensation committee since December 2012. Since 1992, Dr. Moore has served as managing director of Geoffrey Moore Consulting. He is an author, strategic advisor, market development consultant, and organizational design specialist. He also serves as chairman emeritus of TCG Advisors LLC, where he was a managing director from May 2003 until June 2011, as well as Chasm Institute and Chasm Group, management consulting firms he co-founded, since 2011. Dr. Moore has been a venture partner at Mohr Davidow Ventures since February 1998 and serves as an advisor to many of its portfolio companies. From October 2006 until May 2015, Dr. Moore served on the board of directors of Akamai Technologies, Inc., a leading content delivery network and cloud services provider. Dr. Moore received a B.A. in literature from Stanford University and a Ph.D. in literature from the University of Washington.

We believe Dr. Moore’s experience as a strategic advisor, market development consultant, and organizational design consultant, as well as his public company board experience, qualifies him to serve on our board.

| 2012 |

| | | | | |

Douglas Carlisle has served as a member of our board of directors since April 2001, as a member of our audit committee since February 2005 and as a member of our nominating and corporate governance committee since February 2018. Since September 1984, Mr. Carlisle has been a general partner and managing director of Menlo Ventures, a venture capital firm investing primarily in engineering and technology-based early stageearly-stage growth companies. Prior to that, from 1982 to September 1984, Mr. Carlisle was an associate at Menlo Ventures. Mr. Carlisle currently serves on the boards of directors of numerous private companies. Mr. Carlisle received a B.S. in electrical engineering from the University of California, Berkeley and a J.D. and an M.B.A. from Stanford University.

We believe Mr. Carlisle’s extensive experience advising growth-oriented technology companies as a venture capital investor, coupled with his experience as a director of various companies, qualifies him to serve on our board. | 2001 |

| | | | | |

Bill Gossman has served the chairperson of our compensation committee since October 2023, as a member of our board of directors since May 2016, as a member of our compensation committee since April 2022, and previously from May 2016 to February 2018; and as the chairperson of our information and technology security committee from January 2021 to June 2022, and, as a member of our information and technology security committee since January 2021.June 2022 . Mr. Gossman previously served as a member of our technology and security compliance committee from May 2016 to September 2019, as a member of our audit committee from February 2018 to April 2019, and as our acting chief financial officer from April 2001 to July 2001. Mr. Gossman has been a venture partner at Mohr Davidow Ventures since April 2009, when he rejoined the firm after serving from January 2001 to March 2003. In his capacity with Mohr Davidow, he has served on the boards of directors or as chief executive officer of several of its portfolio companies, including HealthTap since May 2018, Marble Security, Inc. from May 2011 to July 2014 and AudienceScience, Inc., where he served as chief executive officer from 2003 to 2007, and again, at the company's request, from June 2016 until June 2017. AudienceScience entered into receivership and began to wind up its operations in June 2017. Prior to Mohr Davidow, Mr. Gossman founded and served as the chief operating officer and chief financial officer for @mobile, a wireless networking company, until its sale to Openwave in 2000. Prior to @mobile, Mr. Gossman served as vice president, strategic planning and international marketing with AT&T Custom Electronic Systems, and in a variety of engineering and management positions with Northrop Corporation and Hughes Aircraft Company. Mr. Gossman received a B.S. in engineering from Cornell University, an M.S. in engineering from the Massachusetts Institute of Technology and an M.B.A. from the University of Maryland. We believe Mr. Gossman’s extensive senior management and business experience in venture capital, and as a founder, director and chief executive officer of numerous companies, qualifies him to serve on our board. | 2016 |

Gary Locke has served as a member of our board of directors since August 2017 and as a member of our nominating and corporate governance committee since February 2018. Mr. Locke previously served as the chairperson of our nominating and corporate governance committee from February 2018 to September 2023. Since 2014, Mr. Locke has been the chairman of Locke Global Strategies LLC, through which he provides strategic advice and consulting services to businesses in the United States and China. From 2011 until 2014, Mr. Locke served as the United States Ambassador to China. Mr. Locke was the United States Secretary of Commerce from 2009 to 2011. Prior to that, Mr. Locke served two consecutive terms as Governor of the State of Washington from 1997 to 2005. Mr. Locke currently serves on the boards of directors of AMC Entertainment Holdings, Inc., an American movie theater chain, and Port Blakely Tree Farms, a family-owned timber company. Mr. Locke served on the board of directors of Fortinet, Inc., a provider of unified threat management solutions, from September 2015 to June 2020. Mr. Locke received a B.A. in political science from Yale University and a J.D. from Boston University. Mr. Locke has served as the interim President of Bellevue College in Bellevue, Washington since June 2020.

We believe Mr. Locke’s extensive leadership, executive experience and global business perspective from his roles as the Governor of Washington, Secretary of Commerce and United States Ambassador to China, coupled with his experience as a director of other public companies, qualifies him to serve on our board. | 2017 |

| | | | | |

| Continuing Directors | Director

Since |

Scott Keeney, one of our co-founders, has served as our president, chief executive officer and as a member of our board of directors since July 2000 and as chairman of our board of directors since February 2018. Prior to joining us, from 1998 to 2000, Mr. Keeney served as chief executive officer for Aculight Corporation, a laser company acquired by Lockheed Martin Corporation in 2008. Prior to that, he served as a consultant for McKinsey & Company, a consulting firm, from 1993 to 1998. Mr. Keeney received a B.A. in economics from the University of Washington and an M.B.A. from Harvard Business School. We believe Mr. Keeney’s perspective, experience and institutional knowledge as our co-founder, president and chief executive officer qualify him to serve on our board. | 2000 |

Camille Nichols has served as a member of our board of directors since November 2020 and as a member of our information and technology security committee since January 2021, serving as chairperson of that committee since June 2022. Ms. Nichols has served as Interim President of nLIGHT DEFENSE Systems, Inc. since April 2024. She retired as a Major General in the U.S. Army following an extensive career that included key roles in Department of Defense acquisition and operations. During her career with the Army, Ms. Nichols managed significant organizations, operating budgets, and programs. Immediately prior to her retirement from the Army, she served as director of the Sexual Assault Prevention and Response Office within the Office of the Secretary of Defense and as the Deputy Commanding General of the Army’s Installation Management Command. From July 2020 to May 2022, she served as the Executive Vice President, Project Services at Amentum, a global technical and engineering services firm, where she was responsible for contracts and procurement, ethics, information systems, security, and real estate. Prior to joining Amentum, Ms. Nichols was Vice President of Business Operations of Fluor Corporation’s government group from May 2017 to July 2020. She currently serves on the board of directors of Concurrent Technologies Corporation, a nonprofit, applied scientific research and development professional services organization. She holds a B.S. degree from the United States Military Academy at West Point, an M.S.S.M. degree in systems management from the University of Southern California, and a Ph.D. in engineering management from The George Washington University.

We believe Ms. Nichols' extensive background and experience in the U.S. military and defense industry, combined with her technical education and background in operations, procurement and security, qualifies her to serve on our board. | 2020 |

Bandel Caranohas served as a member of our board of directors since April 2001, as a member of our compensation committee from February 2004 to December 2012, as a member of our technology security compliance committee from February 2018 to September 2019 and from February 2005 to November 2006, and as a member of our information and technology security committee since January 2021. Mr. Carano is a general partner of Oak Investment Partners, a multi-stage venture capital firm he joined in 1985. From 1983 to 1985, Mr. Carano was a member of Morgan Stanley's Venture Capital Group, where he was responsible for advising Morgan Stanley on high-tech new business development and sponsoring venture investments. Mr. Carano currently serves on the boards of directors of numerous private companies. Mr. Carano served on the board of directors of Kratos Defense & Security Solutions, Inc. from 1998 to September 2019 and NeoPhotonics Corporation from 2004 to August 2022. Mr. Carano also serves on the Investment Advisory Board of the Stanford Engineering Venture Fund. Mr. Carano received a B.S. and an M.S. in electrical engineering from Stanford University.

We believe Mr. Carano’s technical engineering background and experience advising growth-oriented technology companies as a venture capital investor, coupled with his experience as a director of numerous public and private companies, qualifies him to serve on our board. | 2001 |

| | | | | |

Raymond Linkhas served as a member of our board of directors since December 2010, as a member of our compensation committee since December 2011 and as chairperson of our audit committee since December 2010. Since January 2018, Mr. Link has served as a finance lecturer at the University of California, Santa Barbara in a part-time role. From July 2005 to April 2015, Mr. Link served as chief financial officer of FEI Company, a leading supplier of scientific and analytical instruments for nanoscale imaging. Prior to FEI, from July 2001 to June 2005, Mr. Link was the chief financial officer of TriQuint Semiconductor, Inc., a manufacturer of electronic signal processing components for wireless communications which he joined in 2001 as a result of TriQuint's merger with Sawtek, Inc., where he was the chief financial officer. Mr. Link served on the board of directors of Electro Scientific Industries, Inc., a supplier of laser-based solutions for the microelectronics industry, from August 2015 until the completion of its acquisition by MKS Instruments in February 2019, Cascade Microtech from January 2005 until its acquisition by FormFactor in June 2016, and currently serves on the board of directors of FormFactor, Inc., a leading provider of test and measurement solutions for the semiconductor industry. Mr. Link received a B.S. in business administration from the State University of New York at Buffalo and an M.B.A. from the Wharton School at the University of Pennsylvania, is a licensed Certified Public Accountant and a fellow with the National Association of Corporate Directors.

We believe Mr. Link’s financial and accounting expertise, including his service as a chief financial officer and extensive experience as a public company director, qualifies him to serve on our board. | 2010 |

Geoffrey Moore has served as a member of our board of directors since September 2012, as chairperson of our nominating and corporate governance committee since October 2023, as a member of our audit committee since April 2019, and as a member of our compensation committee since December 2012. Since 1992, Dr. Moore has served as managing director of Geoffrey Moore Consulting. He is an author, strategic advisor, market development consultant, and organizational design specialist. He also serves as chairman emeritus of TCG Advisors LLC, where he was a managing director from May 2003 until June 2011, as well as Chasm Institute and Chasm Group, management consulting firms he co-founded, since 2011. Dr. Moore has been a venture partner at Mohr Davidow Ventures since February 1998 and serves as an advisor to many of its portfolio companies. From October 2006 until May 2015, Dr. Moore served on the board of directors of Akamai Technologies, Inc., a leading content delivery network and cloud services provider. Dr. Moore received a B.A. in literature from Stanford University and a Ph.D. in literature from the University of Washington.

We believe Dr. Moore’s experience as a strategic advisor, market development consultant, and organizational design consultant, as well as his public company board experience, qualifies him to serve on our board. | 2012 |

Director Independence

Under the rules of the Nasdaq Stock Market, independent directors must comprise a majority of a listed company's board of directors. In addition, the rules of the Nasdaq Stock Market require that, subject to specified exceptions, each member of a listed company's audit, compensation and nominating and corporate governance committees must be independent. Under the rules of the Nasdaq Stock Market, a director will only qualify as an “independent director” if, in the opinion of that company's board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).Act. To be considered independent for purposes of Rule 10A-3, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board of directors or any other board committee: (i) accept, directly or indirectly, any consulting, advisory or other

compensatory fee from the listed company or any of its subsidiaries or (ii) be an affiliated person of the listed company or any of its subsidiaries.

Our board of directors has undertaken a review of its composition, the composition of its committees and the independence of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Our board of directors considered relationships and all other facts and circumstances deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director. In connection with its review and determination that Ms. Nichols is not independent, our board of directors also considered the employment that Ms. Nichols began with us in April 2024 and the related services that Ms. Nichols provides to us as Interim President of nLIGHT DEFENSE Systems, Inc., our wholly owned subsidiary, including estimated cash compensation of $232,000 and anticipated grant of 25,000 RSUs to Ms. Nichols in connection with her employment in 2024, and the prior consulting services provided by Ms. Nichols to us pursuant to a technical services consulting agreement, including that we made aggregate payments to Ms. Nichols under that agreement equal to approximately $81,000 in 2023.

There are no family relationships among any of our directors or executive officers.

Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our board of directors has determined the following:

| | | | | |

| Directors | | | | | Status |

DirectorsScott Keeney | StatusNot Independent |

Scott KeeneyBandel Carano | Not Independent |

Bandel CaranoDouglas Carlisle | Independent |

Douglas CarlisleBill Gossman | Independent |

Bill GossmanRaymond Link | Independent |

Raymond LinkGary Locke | Independent |

Gary LockeGeoffrey Moore | Independent |

Geoffrey Moore | Independent |

| Camille Nichols | Not Independent |

Board Leadership Structure

Scott Keeney, our president and chief executive officer, is also the chairman of our board of directors. Our board of directors has determined that having our principal executive officer also serve as the chairman of our board of directors, along with having a lead independent director, provides us with optimally effective leadership and is in the best interests of our company and stockholders. Mr. Keeney founded and has led our company since its inception. Our board of directors believes that Mr. Keeney's strategic vision for our business, his in-depth knowledge of our products, the laser industry and his experience serving as our president and chief executive officer since our inception make him well qualified to serve as chairman of our board.

The role given to the lead independent director helps ensure a strong independent and active board of directors. Our board of directors has appointed Bill Gossman to serve as our lead independent director. As lead independent director, Mr. Gossman presides over periodic meetings of our independent directors, serves as a liaison between the chairperson of our board of directors and the independent directors and performs such additional duties as our board of directors may otherwise determine and delegate.Our corporate governance guidelines limit the service of our lead independent director to three years from the date of appointment unless the board of directors otherwise determines that continued service for more than three years would be in the best interests of our company and our stockholders.

Executive Sessions of Non-Employee Directors

In order to encourage and enhance communication among non-employee directors, and as required under the applicable rules of the Nasdaq Stock Market, our corporate governance guidelines provide that the non-employee directors of our board of directors will meet in executive sessions without management directors or company management present on a periodic basis, but no less than twice a year.

Board and Committee Meetings

During 2021,2023, our board of directors held fiveseven meetings (including regularly scheduled and special meetings), and no director attended less than 75% of the aggregate of (1) the total number of meetings of our board of directors held during the period for which he or she has been a director and (2) the total number of meetings held by all committees of our board of directors during the periods that he or she served on those committees.

Although we do not have a formal policy regarding attendance by members of our board of directors at annual meetings of stockholders, we encourage our directors to attend. FourFive of our directors who served at the time of the prior year's annual meeting of stockholders attended such meeting.

Our board of directors has an audit committee, a compensation committee, a nominating and corporate governance committee, and an information and technology security committee, each of which has the composition and the responsibilities described below. The information and technology security committee was formed January 21, 2021. Members serve on these committees until their resignation or until as otherwise determined by our board of directors.

| | | | | | | | | | | | | | |

| Directors | Audit | Compensation | Nominating

and Corporate Governance | Information and Technology Security |

| Scott Keeney | | | | |

| Bandel Carano | | | | ü |

| Douglas Carlisle | ü | | ü | | ü |

| Bill Gossman | | Chairperson | | ü | | Chairperson |

| Raymond Link | Chairperson | ü | | |

| Gary Locke | | | ü | | Chairperson | |

| Geoffrey Moore | ü | Chairpersonü | Chairperson | |

| Camille Nichols | | | | üChairperson |

Audit Committee

The members of our audit committee are Raymond Link, chairperson, Douglas Carlisle and Geoffrey Moore. Our board of directors determined that each of Messrs. Link, Carlisle and Moore satisfy the independence standards for

audit committee members established by applicable SEC rules and the rules of the Nasdaq Stock Market. Each member of our audit committee meets the financial sophistication requirements of the Nasdaq Stock Market. Our audit committee chairperson, Raymond Link, is our audit committee financial expert, as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002, and possesses financial sophistication, as defined under the rules of the Nasdaq Stock Market. Our audit committee oversees our corporate accounting and financial reporting process and assists our board of directors in monitoring our financial systems. Our audit committee:

•approves the hiring, discharging and compensation of our independent registered public accounting firm;

•pre-approves all audit and permissible non-audit services provided by our independent registered public accounting firm;

•supervises and evaluates the work of our independent registered public accounting firm;

•evaluates the independence of our independent registered public accounting firm;

•reviews and discusses our annual and quarterly financial statements and related disclosures with management and with our independent registered public accounting firm;

•prepares an audit committee report to be included in our annual proxy statement;

•reviews and discusses with management, our internal auditor and our independent registered public accounting firm the adequacy and effectiveness of our internal controls and disclosure controls and procedures;

•establishes policies regarding hiring employees from our independent registered public accounting firm and procedures for the receipt and retention of accounting related complaints and concerns;

•reviews and discusses major financial risks and steps to monitor and control those risks with management and our independent registered public accounting firm;

•reviews our related party transaction policies and oversees all transactions, as required by law; and

•reviews and monitors compliance with our code of business conduct and ethics with regard to potential and actual conflicts of interest.

Our audit committee was established in accordance with Section 3(a)(58)(A) of the Exchange Act and operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the Nasdaq Stock Market. A copy of the charter of our audit committee is available on our website at https://investors.nlight.net/governance/. During our fiscal year ended December 31, 2021,2023, our audit committee held four meetings.

Compensation Committee

The members of our compensation committee are Bill Gossman, chairperson effective October 1, 2023, Geoffrey Moore, chairperson through September 30, 2023, and Raymond Link and Bill Gossman. Geoffrey Moore is the chairperson of our compensation committee.Link. Our board of directors determined that each member of our compensation committee satisfies the independence standards for compensation committee members established by applicable SEC rules and the rules of the Nasdaq Stock Market and is a “non-employee director” within the meaning of Rule 16b-3 under the Exchange Act. Our compensation committee oversees our compensation policies, plans and benefits programs. The compensation committee:

•sets compensation for our executive officers;

•oversees compensation plans and programs, and overall compensation philosophy for our officers and employees;

•administers our equity compensation plans;

•evaluates and makes recommendations on director compensation to the Board; and

•reviews and discusses with management our compliance and governance procedures, including our reporting obligations to the SEC and our stockholders.

Our compensation committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the Nasdaq Stock Market. A copy of the charter of our compensation committee is available on our website at https://investors.nlight.net/governance/. This charter authorizes the compensation committee to delegate authority to subcommittees or individuals as the committee deems appropriate, to the extent consistent with applicable law. During our fiscal year ended December 31, 2021,2023, our compensation committee held sixfour meetings.

Nominating and Corporate Governance Committee

The members of our nominating and corporate governance committee are Geoffrey Moore, chairperson effective October 1, 2023, Gary Locke, chairperson through September 30, 2023, and Douglas Carlisle. Gary Locke is the chairperson of our nominating and corporate governance committee. Our board of directors determined that each member of our nominating and corporate governance committee satisfies the independence standards for nominating and corporate governance committee members established by applicable SEC rules and the rules of the Nasdaq Stock Market. Our nominating and corporate governance committee oversees and assists our board of directors in reviewing and recommending nominees for election as directors. The nominating and corporate governance committee:

•oversees our board composition, evaluation and nominating activities;

•annually reviews the structure and composition of each of our board committees and makes recommendations to the board, as necessary; and

•oversees our corporate governance policies.

The nominating and corporate governance committee may engage consultants or third-party search firms to assist it in identifying and evaluating potential director nominees, and to help identify director prospects, perform candidate outreach, assist in reference checks and provide other related services. Our nominating and corporate governance committee operates under a written charter that satisfies the applicable listing standards of the Nasdaq Stock Market. A copy of the charter of our nominating and corporate governance committee is available on our website at https://investors.nlight.net/governance/. During our fiscal year ended December 31, 2021,2023, our nominating and corporate governance committee held two meetings.one meeting and our board of directors otherwise fulfilled the responsibilities of the nominating and corporate governance committee during 2023.

Information and Technology Security Committee

Effective January 21, 2021,The members of our board of directors formed an information and technology security committee comprised of Bill Gossman, as chairman,are Camille Nichols, chairperson, Bandel Carano and Camille Nichols.Bill Gossman. The information and technology security committee:

•assesses our information and technology related risks, including physical and cyber security, insider threats and information security risk exposures;

•reviews emerging threats to information and technology security as they relate to our business;

•reviews policies, practices, processes, procedures, risk management and internal controls applicable to our information and technology, including in the areas of physical and cyber security, information governance, insider threats, intellectual property protection, global trade compliance and business activities which involve matters that have been classified for purposes of national security by an agency or instrumentality of the government customer;

•assesses the effectiveness of our policies, practices, processes, procedures and internal controls in the aforementioned areas, and reviews practices and trends of the market, to identify, monitor and mitigate information and technology related risks; and

•recommends policies, practices, processes, procedures, risk management and internal controls to mitigate our information and technology related risks.

Our information and technology security committee operates under a written charter, a copy of which is available on our website at https://investors.nlight.net/governance/. During our fiscal year ended December 31, 2021,2023, our information and technology security committee held fourtwo meetings.

Compensation Committee Interlocks and Insider Participation

The members of our compensation committee are Geoffrey Moore, Raymond Link and Bill Gossman. None of the members of our compensation committee is, or was in the past year, an officer or employee of us.ours. None of our executive officers currently serves, or in the past year has served, as a member of the board of directors or compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of any entity that has, or had in the past

year, one or more executive officers serving on our board of directors or compensation committee. See “Certain Relationships and Related Party Transactions” for additional information.

Considerations in Evaluating Director Nominees

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees. In its evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of the board of directors and the needs of the board of directors and the respective committees of the board of directors. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, integrity, judgment, diversity, age, independence, skills, education, expertise, business acumen, business experience, length of service, understanding of our business, other commitments and the like. Other than the foregoing, there are no stated minimum criteria for director nominees.

Our board of directors believes that our board should be a diverse body and is committed specifically to achieving gender diversity. Although our board of directors does not maintain a specific policy with respect to board diversity, our corporate governance guidelines provide that the nominating and corporate governance committee may consider diversity, with respect to professional background, education, race, ethnicity, gender, age and geography, as one factor in assessing director candidate qualifications. Our nominating and corporate governance committee also considers these and other factors as it oversees the annual board of directors and committee evaluations. See “—Stakeholder Engagement and Governance Practices—Enhancing Director Diversity” below for additional information.

Our nominating and corporate governance committee evaluates additional director candidates from time to time using the criteria discussed above to identify qualified candidates. When qualified candidates are identified, we may appoint such candidates to vacancies on our board of directors separate from the election of directors by our stockholders at our annual meetings. Any vacancies on the board of directors occurring between our annual meetings of stockholders may be filled by persons selected by a majority of the directors then in office, although less than a quorum, or by a sole remaining director, and any director so elected will serve for the remaining term of the class of directors in which the vacancy occurred.

Board Diversity Matrix as of April 26, 2024

| | | | | | | | | | | | | | |

| Board size: | | | | |

| Total number of directors | 8 |

| Male | Female | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | |

| Directors | 5 | 1 | | 2 |

| Part II: Demographic Background |

| African American or Black | | | | |

| Alaskan Native of American Indian | | | | |

| Asian | 1 | | | |

| Hispanic or Latinx | | 1 | | |

| Native Hawaiian or Pacific Islander | | | | |

| White | 4 | | | |

| Two or More Races or Ethnicities | | | | |

| LGBTQ+ | |

| Did Not Disclose Demographic Background | 2 |

Stockholder Recommendations for Nominations to the Board of Directors

The nominating and corporate governance committee will consider candidates for directors recommended by stockholders so long as such recommendations comply with the certificate of incorporation and bylaws of our company and applicable laws, rules and regulations including those promulgated by the SEC. The committee will evaluate such recommendations in accordance with its charter, our bylaws, and the regular nominee criteria described above. This process is designed to ensure that the board of directors includes members with diverse backgrounds, skills and experiences, including appropriate financial and other expertise relevant to our business. Eligible stockholders wishing to recommend a candidate for nomination should contact our corporate secretary in writing. Such recommendations must include information about the candidate, a statement of support by the recommending stockholder, evidence of the recommending stockholder’s ownership of our stock and a signed letter from the candidate confirming willingness to serve on our board of directors. The committee has discretion to decide which individuals to recommend for nomination as directors.

A stockholder of record can nominate a candidate directly for election to the board of directors by complying with the procedures in Section 2.4(ii)2.4 of our bylaws. Any eligible stockholder who wishes to submit a nomination should review the requirements in the bylaws on nominations by stockholders. Any nomination for our 2025 annual meeting should be sent in writing to nLIGHT, Inc., Attention: Corporate Secretary, 4637 NW 18th Avenue, Camas, Washington 98607. We must receive the notice no earlier than 8:00 a.m., Pacific time on February 11, 2023,10, 2025, and no later than 5:00 p.m., Pacific time on March 13, 2023.12, 2025. The notice must state the information required by Section 2.4(ii)(b)2.4 of our bylaws and otherwise must comply with applicable federal and state law.

Communications with the Board of Directors

The board of directors believes that management speaks for our company. Individual directors may, from time to time, meet or otherwise communicate with various constituencies that are involved with our company, but it is expected that directors would do this with knowledge of management and, in most instances, only at the request of management.

In cases where stockholders wish to communicate directly with the non-management directors, messages can be sent by mail to the attention of our corporate secretary at 4637 NW 18th Avenue, Camas, Washington 98607. We will forward such communications, as appropriate, to the appropriate member(s) of the board of directors or, if none is specified, to the chairperson or lead independent director, as applicable.

Corporate Governance Guidelines and Code of Business Conduct and Ethics

Our board of directors has adopted corporate governance guidelines that address items such as the qualifications and responsibilities of our directors and director candidates, including independence standards, and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a written code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions. The full text of our corporate governance guidelines and our code of business conduct and ethics is posted on our website, https://investors.nlight.net/governance/. The information on, or that can be accessed through, our website is not part of this filing. We intend to disclose any amendments to the code of business conduct and ethics, or any waivers of its requirements, on our website to the extent required by the applicable rules and exchange requirements.

StakeholderStockholder Engagement and Governance Practices

We maintain active, year-round engagement with our stockholders and other key stakeholders, including our customers, suppliers, and members of the communities in which we operate. In our engagement meetings with stockholders we have discussedregularly discuss a variety of topics, including but not limited to our financial and operating performance, our business and growth strategy, governance matters and executive compensation. We value the insights and feedback we gather from these engagements.

We launched a more targeted engagement program to better understand stockholder views on our compensation program and environmental, social, and governance ("ESG") practices in 2020 and, in 2021, published our first ESG report. We proactively arrange calls and meetings between stockholders and management, including our chairman of theengagements, which help inform board president and chief executive officer, to discuss these and other issues of interest to investors.decisions. We believe our engagement program provides stockholders with an effective channel for two-way dialogue with both our board of directors and management.

We are committed to listening to our stockholders on these important topics. We plan to continue our stockholder engagement program in 2022 under the oversight of the board of directors to further enhance and deepen our relationship with our stockholders with respect to our ESG practices, our executive compensation program, and other issues of interest to our stockholders.

Our board of directors approaches governance in a strategic and thoughtful manner, taking into consideration multiple perspectives, including those of our nominating and corporate governance committee, our individual directors, our stockholders, our employees, various experts and other stakeholders. Our good governance practices and programs include the following:

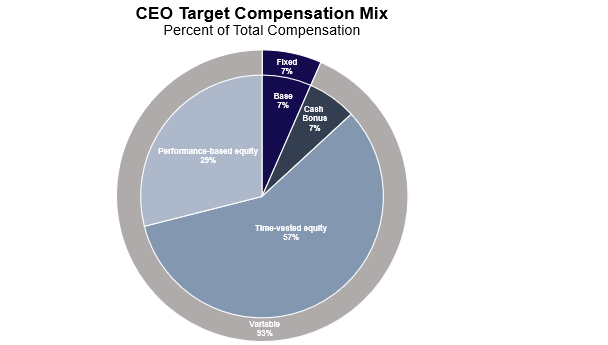

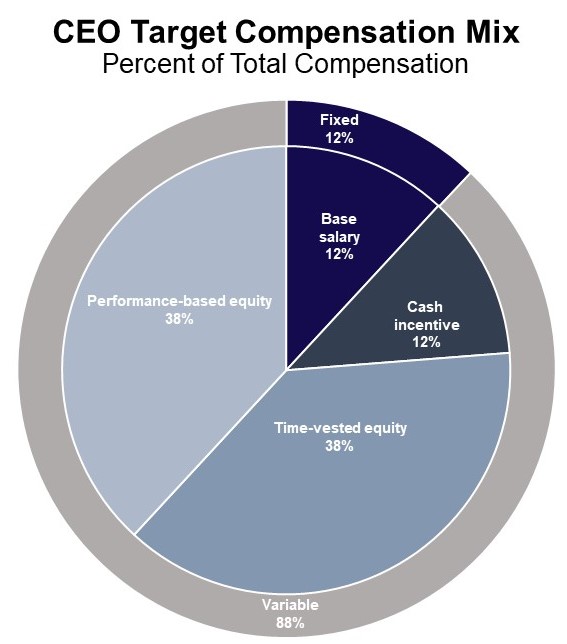

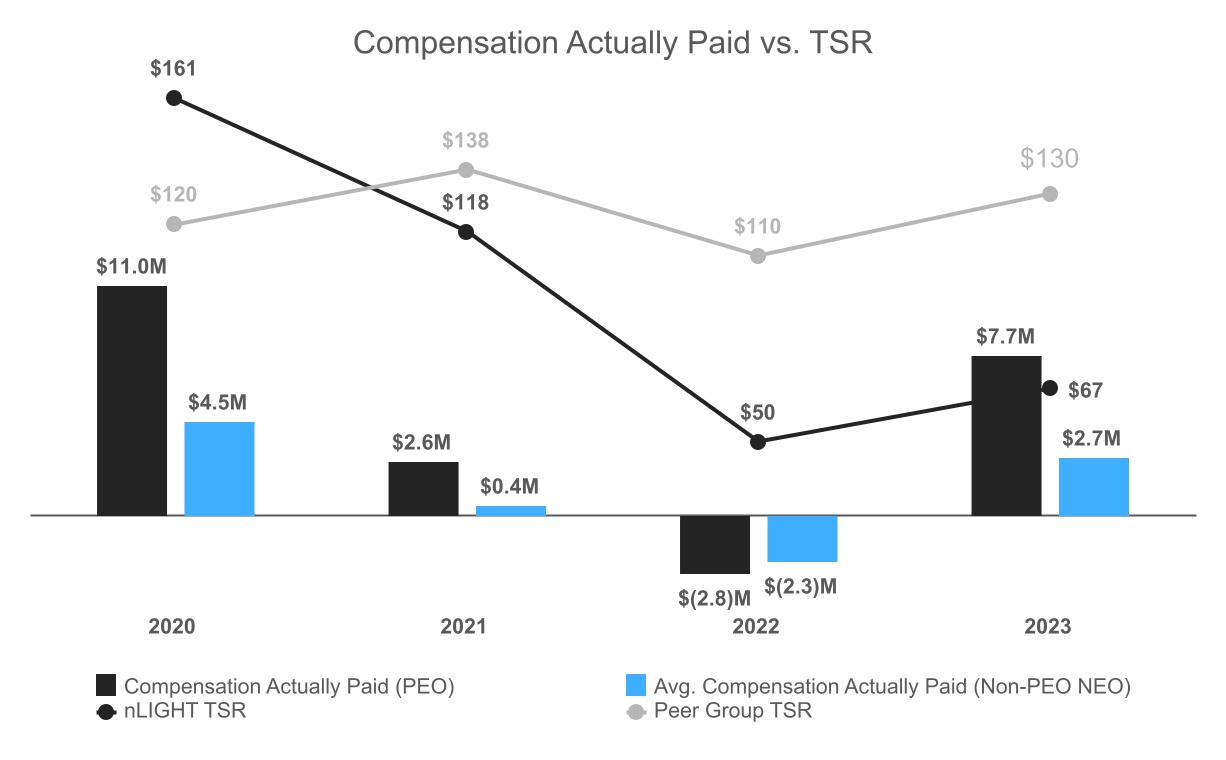

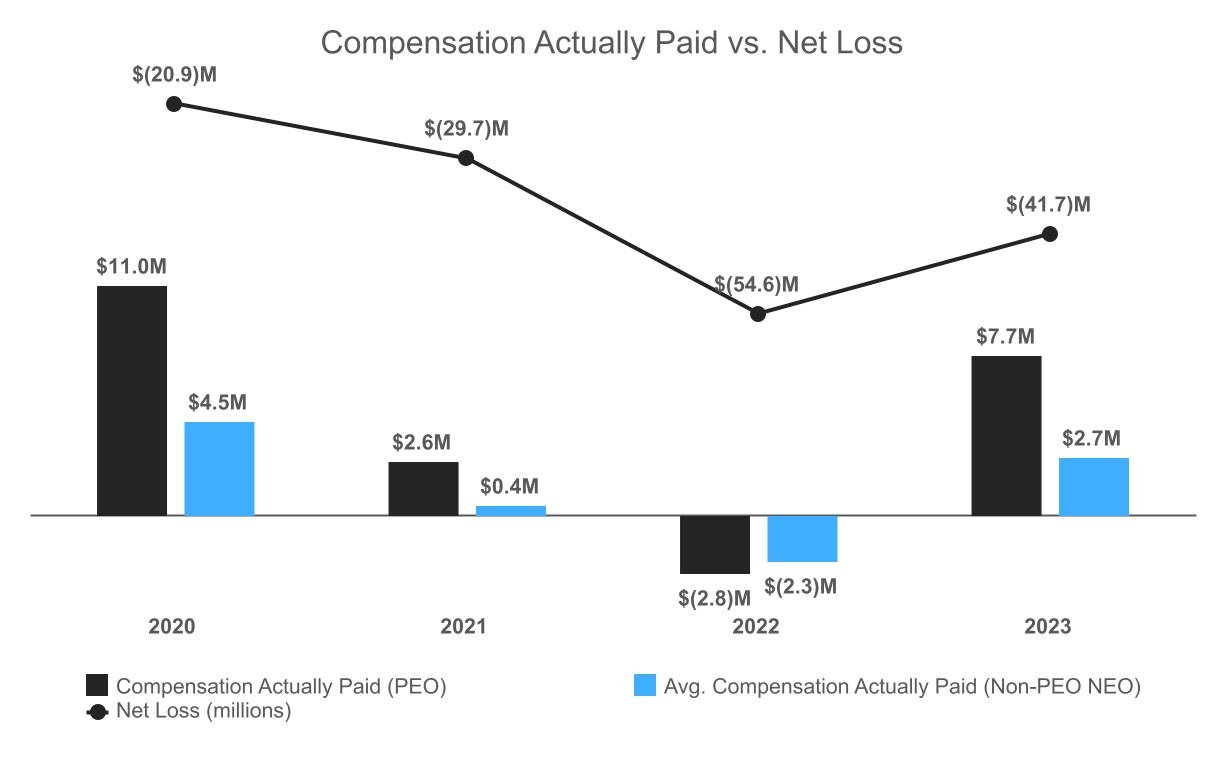

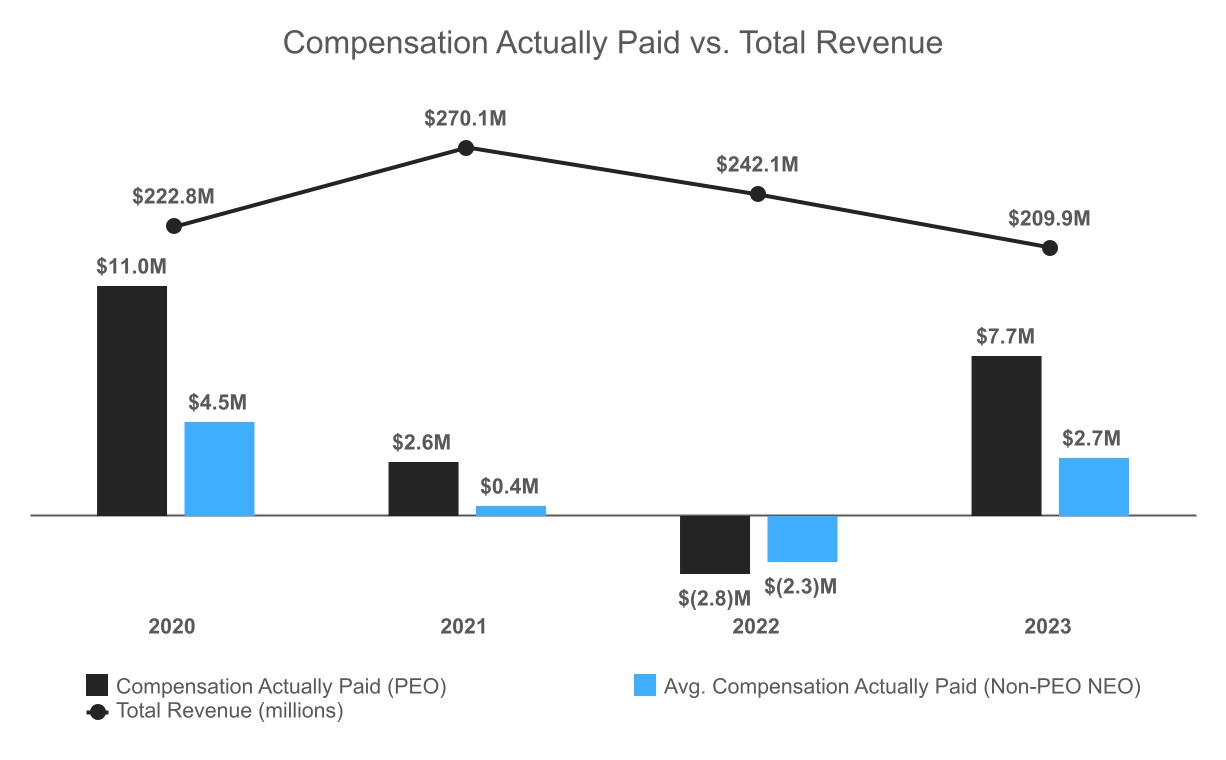

•Equity Ownership Guidelines. We maintain equity ownership guidelines applicable to our non-employee directors who receive compensation pursuant to our outside director compensation policy and our executive officers. The guidelines allow for a compliance period, which in each case is the fifth anniversary of the later of the effective date of the guidelines or the date the applicable director or executive officer becomes a director or executive officer. The guidelines require non-employee directors to hold equity interests in our company with an aggregate value equal to three times the annual cash retainer for board service by the end of their respective compliance periods. Our chief executive officer will be required to hold equity interests in our company with an aggregate value equal to three times annual salary by the end of his compliance period. Other executive officers will be required to hold equity interests in our company with an aggregate value equal to such executive officer’s annual salary by the end of their respective compliance periods. For purposes of satisfying the equity ownership guidelines, equity interests only include issued shares of our common stock: (1) directly owned by a director or executive officer or his or her immediate family members residing in the same household; (2) beneficially owned by director or executive officer, but held in trust, limited partnerships, or similar entities for the sole benefit of the director or executive officer or his or her immediate family members residing in the same household; and (3) held in retirement or deferred compensation accounts for the benefit of a director or executive officer or his or her immediate family members residing in the same household.